A person may, at any point, need a personal loan for a variety of situations: It could be a marriage loan for a loved one’s wedding, a medical loan for an impending surgery or as an advance pay check because they may have used up their monthly salary. And personal loans can quickly become a necessity when one’s income is low or unsteady. The sources of finance they immediately seek can be- Friends & Family, Local moneylenders or chit funds. All of which comes with their own inherent shortcomings.

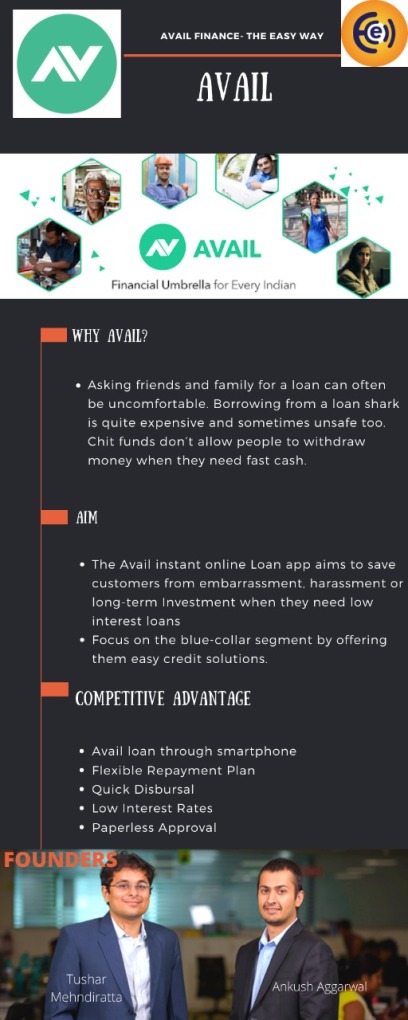

Asking friends and family for a loan can often be uncomfortable. Borrowing from a loan shark is quite expensive and sometimes unsafe too. Chit funds don’t allow people to withdraw money when they need fast cash. As a solution to this issue the Avail instant loan app was established by Bengaluru based start-up Avail Finance.

The Avail instant online loan app aims to save customers from embarrassment, harassment or long-term investment when they need low interest loans. Avail Finance provides Indians with an instant online loan app built for them to have access to fast cash anytime, anywhere. Avail provides unsecured online loans in a quick and easy manner with a hassle-free loan application that requires minimal paperwork. Not only that, but Avail’s low interest personal loans also help one build a credit history through timely, simple repayment.

Started in 2017 by Ankush Aggarwal and Tushar Mehndiratta, Avail Finance focuses on the blue-collar segment by offering them easy credit solutions. Its multiple products like personal loans, salary advances, and savings are customized for the blue-collar segment. It also helps its customers in understanding the importance of being financially independent.

Ankush Aggarwal (on the right) and Tushar Mehndiratta Founders Avail Finance

Ankush Aggarwal (on the right) and Tushar Mehndiratta Founders Avail Finance

The target group of this start-up, as mentioned earlier, is the blue-collar segment in India, which includes security guards, delivery executives, drivers, housekeeping staff etc, who have a monthly income in the range of Rs 8,000 – Rs 25,000. Avail Finance has two main products. One is a short-term personal loan of Rs 20,000 for five months — the average ticket size and tenure. The other product is of an even smaller ticket size of Rs 5,000 for one month and is an interest-free one to assist them during their frequent cash flow problems. Borrowers have the flexibility to leave a tip if they are satisfied with the service and experience. And this is one of the ways of revenue generation apart from the interest payments.

In June 2019, the start-up raised its Series A funding round of $9 million led by Matrix Partners India. In March 2018, the company raised pre-Series A round of $17.2 million led by Matrix Partners. This round also saw participation from Co-founders of Ola Bhavish Aggarwal and Ankit Bhati, Flipkart Co-founder Binny Bansal, Cred Founder Kunal Shah, and Mswipe Founder Manish Patel.

The competitive advantage it has against its competitors is multifaceted. Some of these are-

- Avail loan through smartphone- A mobile app-only service that puts personal loans just a few swipes away

- Flexible Repayment Plan- No rigorous repayment schedule. Repay according to your convenience

- Quick Disbursal

- Low Interest Rates

- Paperless Approval- Helps you out from the hassles of paperwork. Upload minimal documentation digitally.

- Borrower can get up to 200% of your salary in advance

Considering Avail is operating in a high volume, low ticket size market, Ankush says he looks to sachetising his products like the FMCG companies. One big challenge they face is the missing credit history of the customer. In order to cater to this challenge, they look for alternatives like professional history and other information on the app. The start-up has a 150-member team which works closely with its customer segment. “Our culture is being customer-first and data-obsessed,” says Ankush.